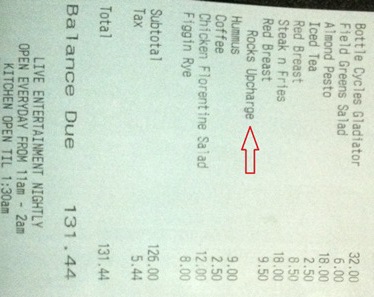

I recently dined at a restaurant with a few colleagues. Two of us ordered a glass of Red Breast Irish Whiskey after our meal. My friend asked for hers neat while I ordered mine on the rocks. Imagine my shock when I saw the bill:

That’s right, my drink was $1 more after the "rocks upcharge" was added. Charging $1 for ice has to be the dumbest fee I’ve ever seen. (If you’ve seen dumber, PLEASE let me know!)

Customers Hate Fees

The sheer outrageousness of that little fee completely ruined what was an otherwise acceptable dining experience. Just to make sure I’m not being overly sensitive, I did a little homework and discovered other customers hate fees too. Here are a few examples:

- A 2006 study by Bain & Company found that fees were one of the leading causes of customer dissatisfaction (read more in their whitepaper).

- A 2011 study by J.D. Power & Associates found that checked baggage fees decreased customer satisfaction by an average of 8.5 percentage points (here's the story).

- High-profile attempts to raise fees by companies like Bank of America have led to widespread public backlash and customer defections.

Bottom line: Fees can negatively influence customers’ perception of service, especially when the fees are for products or services that used to be free.

Companies Are Addicted

For many companies, the fee addiction is easy to explain. The company faces pressure to increase profitability from investors, the board of directors, or competitors. Charging fees seems like a good way to boost revenue, pass costs along to the customer, or both. The financial motivation associated with a new fee is generally easy to measure. Here are a few examples:

- Checked baggage fees added an estimated $3.36 billion in revenue to U.S. airlines’ bottom line in 2011 (source: MSNBC's Overhead Bin).

- Bank of America hatched their plan to charge customers using debit cards a $5 monthly fee after legislation cost them an estimated $2 billion in revenue (source: LA Times).

- Companies in a wide range of industries, from hotels to ticket brokers, use fees to make the cost of their product or service appear lower than it actually is.

Curing the Addiction

Companies will only reduce or eliminate unfriendly fees when they are convinced doing so will increase profitability. Making that case takes both data and guts.

Gathering the data isn’t always easy. It requires companies to look beyond individual transactions and examine their customers relationships. For example, when an airline charges a passenger $25 to check a bag on a flight, the airline knows it made an extra $25. What it might not know is whether the fee encouraged that passenger to book her next flight on another airline. Companies need to get closer to their customers through surveys, mining their CRM programs, and even face-to-face interactions to analyze whether fees are really a net gain or loss.

One way to add guts to the mix and make executives a bit braver is through a compelling success story. Here are a few examples from companies that resisted the urge to raise fees:

- In the mid-2000s, Charles Schwab reduced or eliminated many fees as part of its well-publicized turnaround that led the brokerage firm to increase profits from $109 million in 2002 to $1.2 billion in 2006 (read more).

- An estimated 650,000 people moved their accounts from Bank of America to a credit union in the fall of 2011 in response to an announced fee increase (source: Credit Union National Association).

- Netflix built a successful company with a business model that eliminated late fees for movie rentals. Of course, they also made two enormous blunders in 2011, but that’s a different story.