A few years ago, I was having a conversation with the CEO of a small local credit union. The credit union had hired me to conduct a customer service assessment and I had asked him about his vision for serving credit union members in the future.

The CEO remarked that his biggest wish was to have more branches.

Members enjoyed the credit union's highly-rated service. The challenge was the credit union only had a few locations, which made it difficult to conveniently serve members who were on the go or who lived more than a few miles away from a branch.

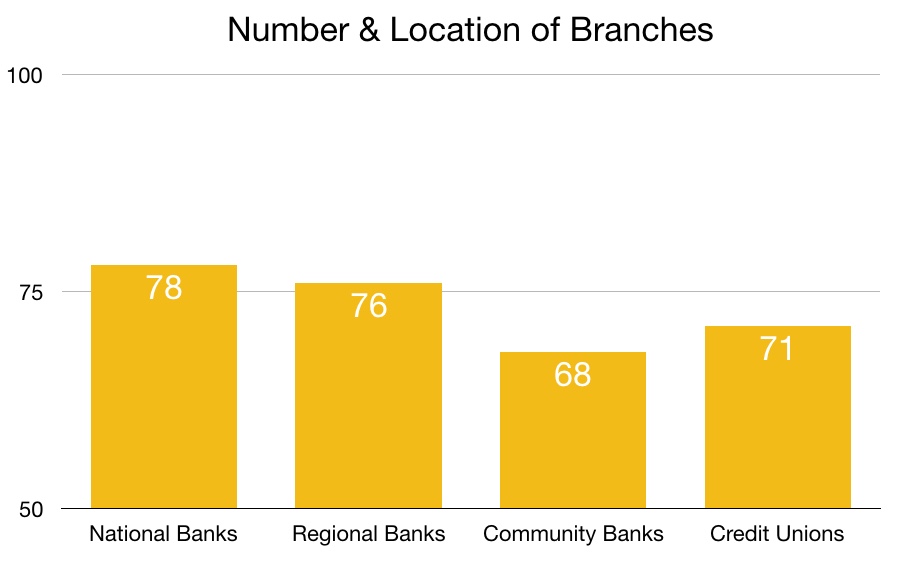

A new report from the American Customer Satisfaction Index (ACSI) shows branches and ATM machines are just about the only place where credit unions and community banks lag behind larger financial institutions.

The also report hints at some lessons for any business that's planning to grow in 2018.

ACSI Banking Report Highlights

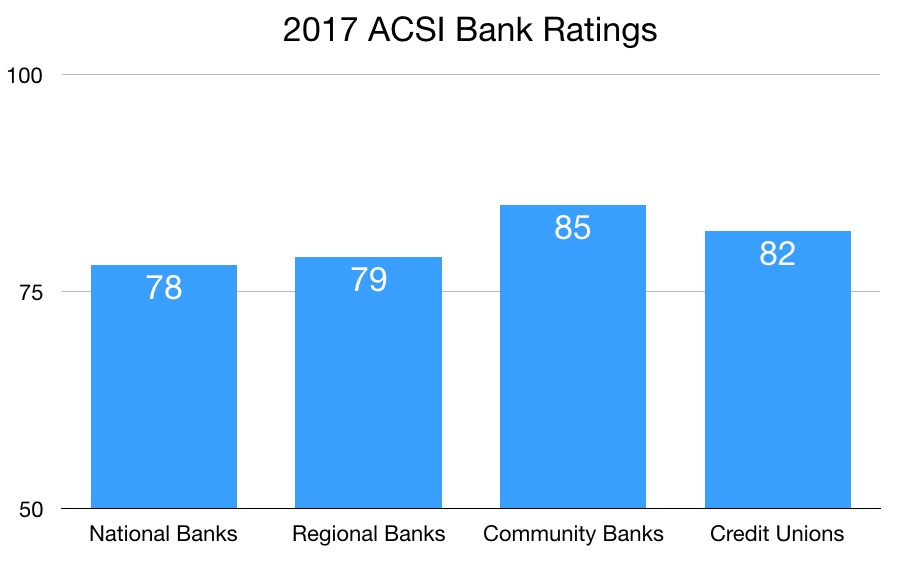

Smaller is better when it comes to service quality, according to the ACSI report. Here's the breakdown of overall customer service ratings by size of bank.

Some of this may be residual impact from Wells Fargo's fake account scandal. Yet businesses across all industries tend struggle with scaling a service culture as they grow.

In banking, for example, there are fundamentally different challenges managing 100 branches than there are managing 10. Maintaining consistent hiring and training practices becomes difficult. Executive leadership begins to have fewer interactions with the front lines or customers.

The inevitable focus drifts to technology, policy, and process as companies get larger and more complex.

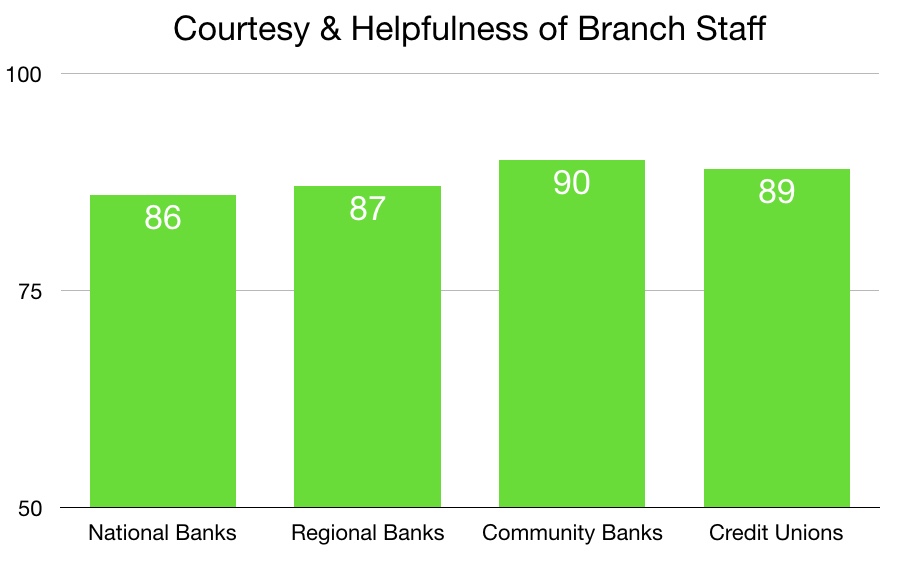

The ACSI ratings for banks and credit unions bear this out. Notice the higher ratings for tellers and other in-branch staff.

The same held true for contact centers.

The only areas where larger banks had a clear customer service advantage was customer satisfaction ratings for the number of locations of branches and ATMs.

Solutions and Takeaways

Many small businesses have a special community feel that's difficult for larger organizations to replicate.

A company in my neighborhood, Ideal Service, provides plumbing, heating, HVAC, and electrical service to customers like me. Each summer, Ideal sponsors a concert series in the local park where the owner, Don Teemsma, and his employees serve free hot dogs.

(I captured some of Teemsma's service secrets in this 2017 interview.)

Big companies could certainly do something similar, though those company leaders might not think to unless the company had a clear customer service vision that focused on building ties with the local community.

A customer service vision is a shared definition of outstanding customer service that points everyone in the same direction. It's essential to have one if you want to keep things consistent as your business grows.

Any business with multiple branches, stores, restaurants, or other types of locations can also take a page from small businesses by training employees to create a warm and welcoming environment.

Start with the 10 and 5 rule, where every customer within ten feet gets a greeting.

Give employees skills such as the Five Question Technique to help them build authentic rapport with customers and encourage your team to learn and use customer names.

One challenge in larger businesses is employees are not very observant. They consistently miss opportunities to serve because their focus is locked in on some task.

You can help employees improve their powers of observation with this short video from my Innovative Customer Service Techniques course.

You'll need a subscription to view the entire course on LinkedIn Learning.